Sending and receiving money from abroad was a hassle a few years back. You would have to deal with bank transfers, which charged you exorbitant rates of exchange and fees.

Today receiving and sending money even from the remotest part of the continent is a breeze – provided the sender or the receiver has an internet connection.

Online payment services like PayPal and Payoneer make it easy to send money locally and internationally.

PayPal and Payoneer, while there are many other online payment services, such as Skrill (also known as Neteller), Stripe and Transferwise, are the most popular.

These platforms are available in more than 200 countries.

Which payment processor is better? This article will compare the differences between Payoneer vs. PayPal and PayPal vs. Payoneer.

Let’s first take a look at PayPal and Payoneer.

PayPal: A Quick Overview

PayPal, formerly known as Confinity and founded in 1998, is a US E-Commerce company specializing in digital money transfers. Confinity merged with X.com in 2000 to create PayPal.

In 2002 the company held its initial public offer. After watching PayPal become the preferred choice for online vendors, shoppers, affiliate bloggers and freelancers in the past year, eBay, a company that runs internet auctions, purchased PayPal at a cost of $1.5 Billion.

PayPal became a publicly traded company in 2015 after eBay separated it from the eBay Group. Since its founding, the company allows users to make secure online payments and exchange money among accounts.

PayPal currently allows users to link accounts with their bank accounts. This makes it easier and faster to send payments in different currencies than using checks or money orders. PayPal supports more than 20 currencies, and it is available in over 200 countries.

The company’s superior anti-hacking, anti-phishing and security measures have helped it become the preferred payment processing platform.

If they believe that they’ve received unfair treatment, the company will refund them. What’s even more, the firm takes security Take it seriously. They can therefore deactivate a bank account in the event of a suspicious transaction.

Payoneer: A Quick Overview

Payoneer has its headquarters in New York. Yuval Tel, an Israeli entrepreneur, founded the company in New York, United States, in 2005. It has since become one of most popular online financial services companies for businesses, freelancers, and affiliate marketers.

The company provides services in more than 200 countries and allows transactions to be made in over 150 currencies.

The company’s business model is to offer its partners and clients prepaid MasterCard Cards, which are then shipped directly to the owners of those cards in different countries. These include businesses, freelancers or affiliate marketers.

You’ll need to activate the card to start receiving payments. Payoneer allows you to withdraw funds in two different ways.

First is the prepaid MasterCard. You do not have to have a banking account in order to use the prepaid MasterCard.

Once your funds have been sent, you can withdraw the money in 24 hours just as you would if you were using a credit card. The card can be used to make online purchases.

You can also link your Payoneer account to your bank account by entering the details. After the funds have been transferred to your Payoneer account, you can move them into your bank account.

It will let you withdraw your money in the local currency, with a low fee. The funds should be in your account within 24hrs, just like with the MasterCard method.

Payoneer can be used to send payments in bulk by companies such as Amazon, Upwork Google and Airbnb. Payoneer is a popular choice for most businesses because of its easy integration with any website.

PayPal vs Payoneer

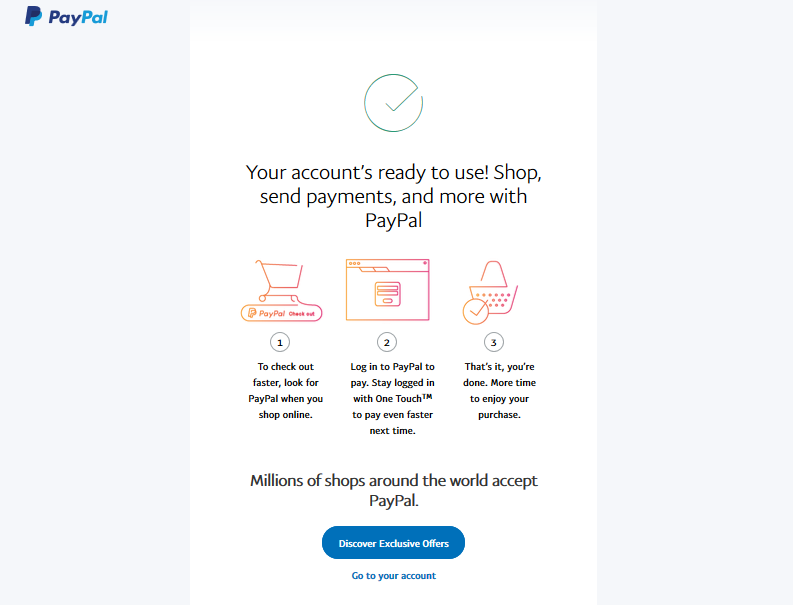

Set up your PayPal account

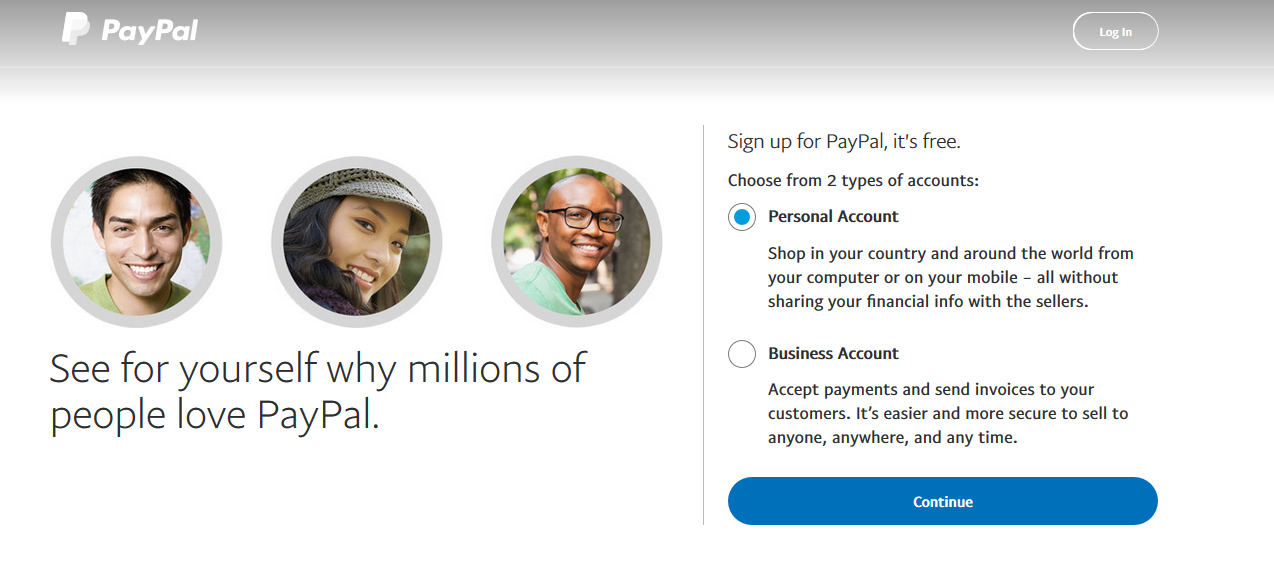

If you do not have a PayPal Follow the steps below to set up a PayPal account. Setup of a PayPal Account is completely free and shouldn’t take more than a couple minutes. You may also wish to link your PayPal account with a bank.

Step #1 Visit the website PayPal homepage.

Step 2: In the upper right corner, click on Sign up.

Step #3 Select whether you wish to create an account for your business or yourself. Click continue.

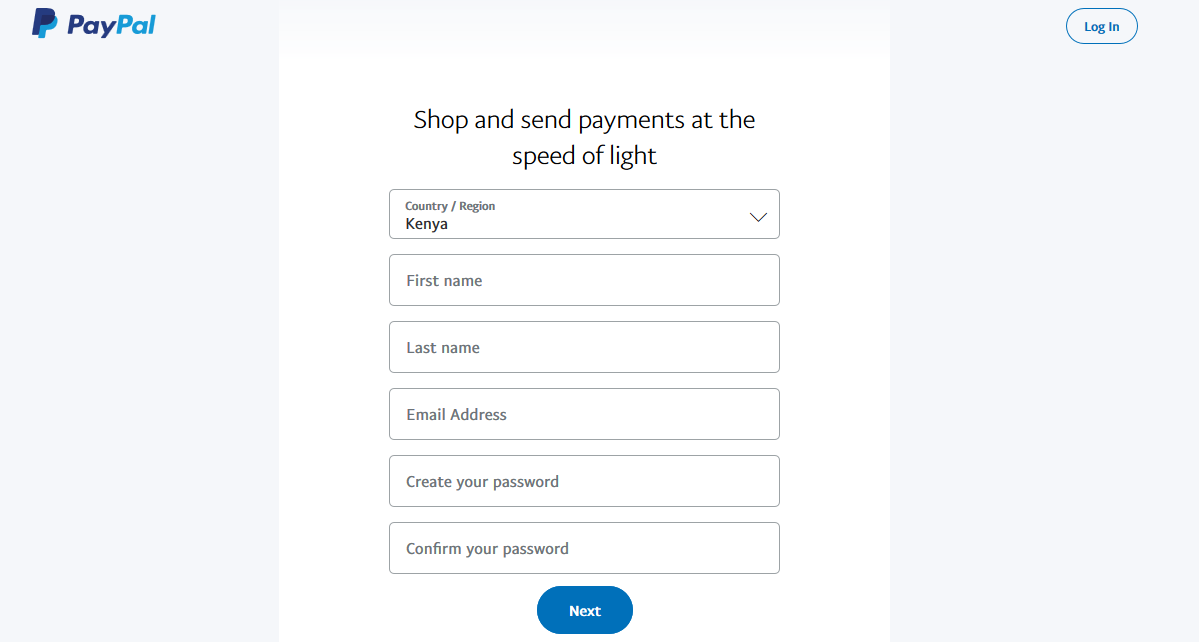

Step 4Enter your personal details on the next screen. This includes your country, names, email address and password. Click or tap on Next.

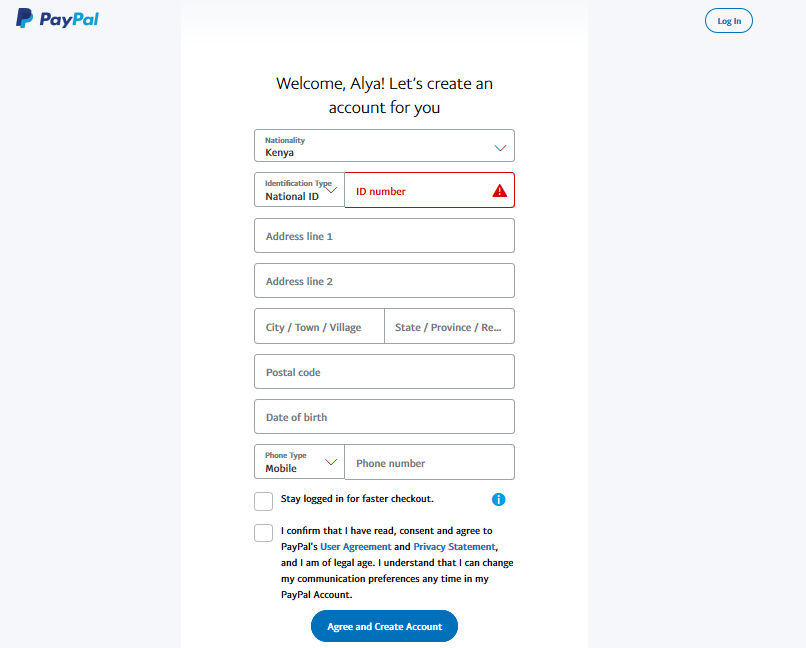

Step #5 You’ll need to enter your ID number, address, date-of-birth, and mobile number on the next page. This information is required and must be entered in order to create your account.

Step #6 After you have finished, click on Accept and Create Account. PayPal lets you choose whether to send or receive payments, start shopping online.

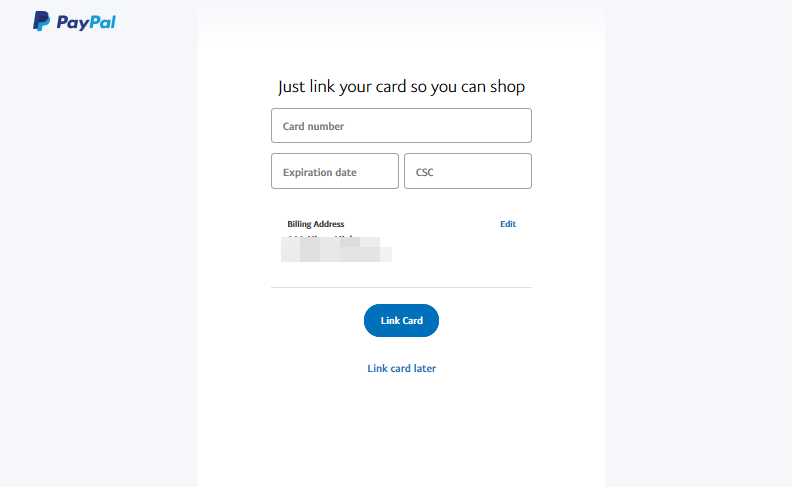

Step #7 Now you can choose whether to link the card now or later (this is an optional step). You will still need to enter this detail if you are planning to receive or send money into your bank account. It will take at minimum three days for your card’s verification.

Set up your Payoneer account

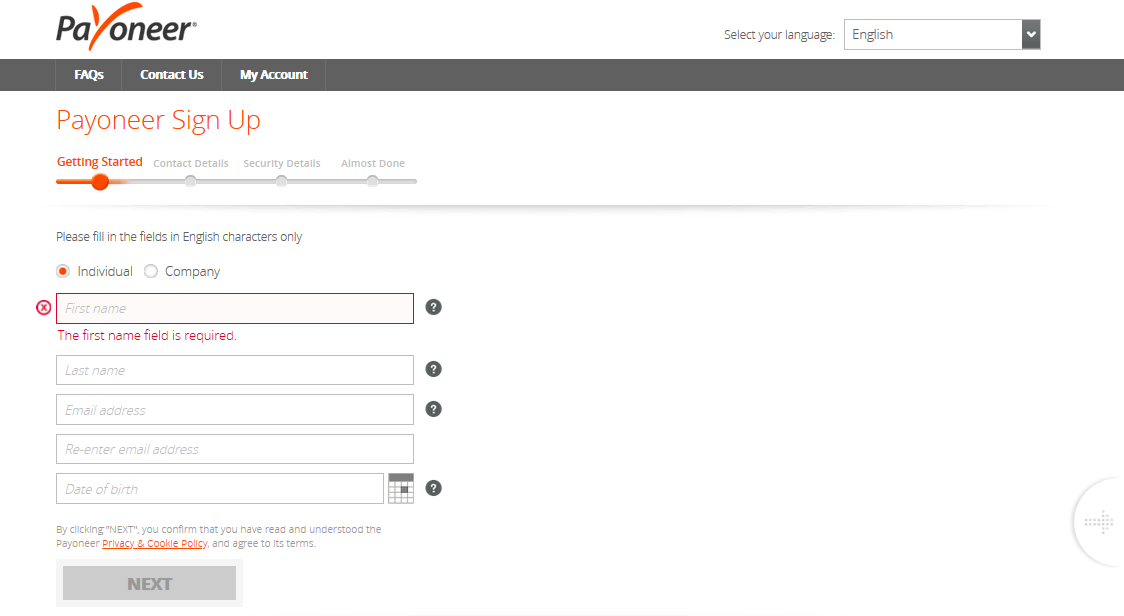

Payoneer accounts are free to create, just like PayPal. Here are the steps you can take to create a Payoneer account if you don’t have one already.

Step 1: Visit the Payoneer homepage.

Step #2 Click on the top-right corner. Register.

Step #3 Click “Next” and enter your email address.

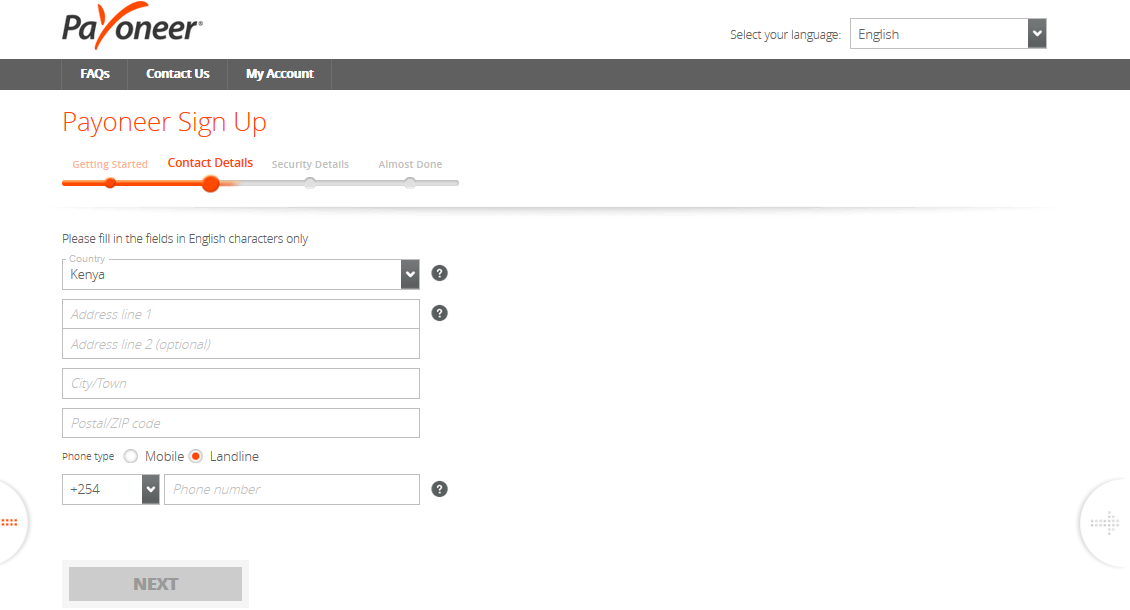

Step #4 The page that follows will ask you to enter both your address and phone number. Then, click “Next” When you are finished,

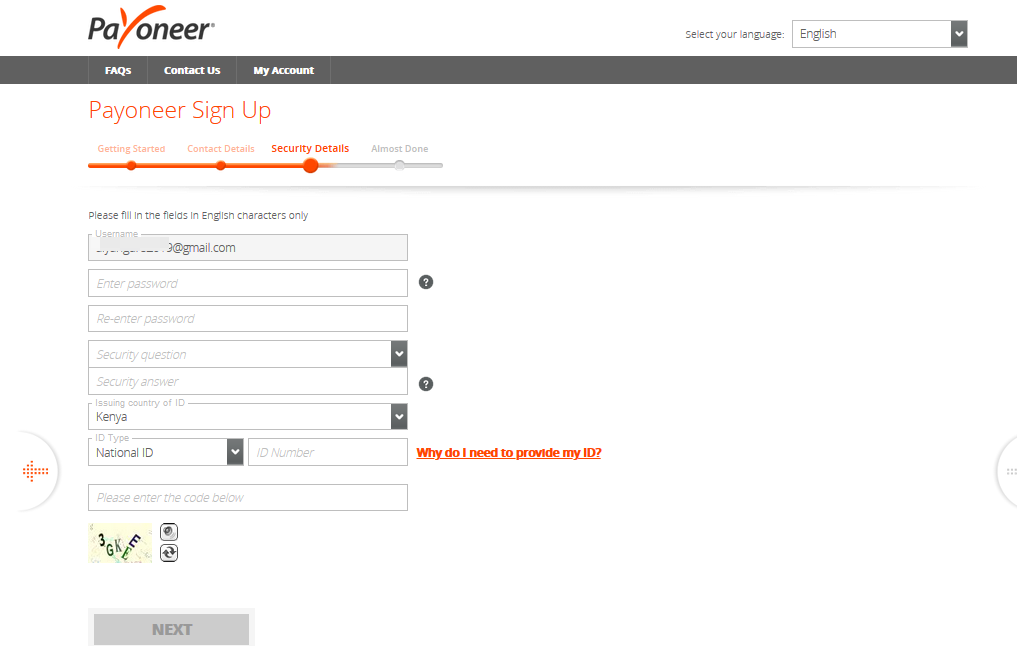

Step #5 Enter your security information on the next page of sign-up. You will need to enter your password, national ID number and answer a question about security.

You can use your passport number or your driver’s licence number instead of your ID. Click Next.

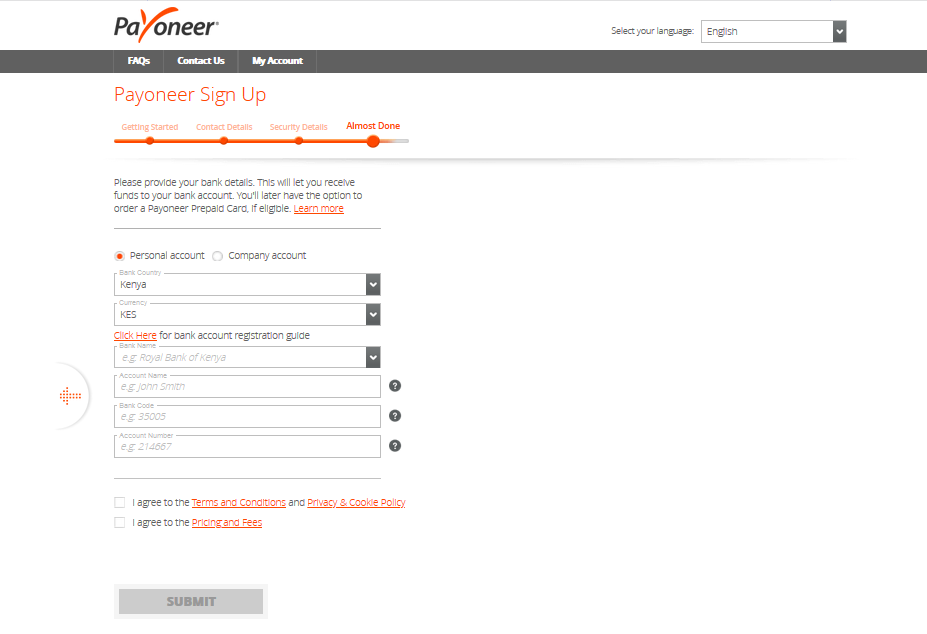

Step #6 You are almost finished. All you need to do now is enter the bank details including your local currency. To review your account, click the submit button.

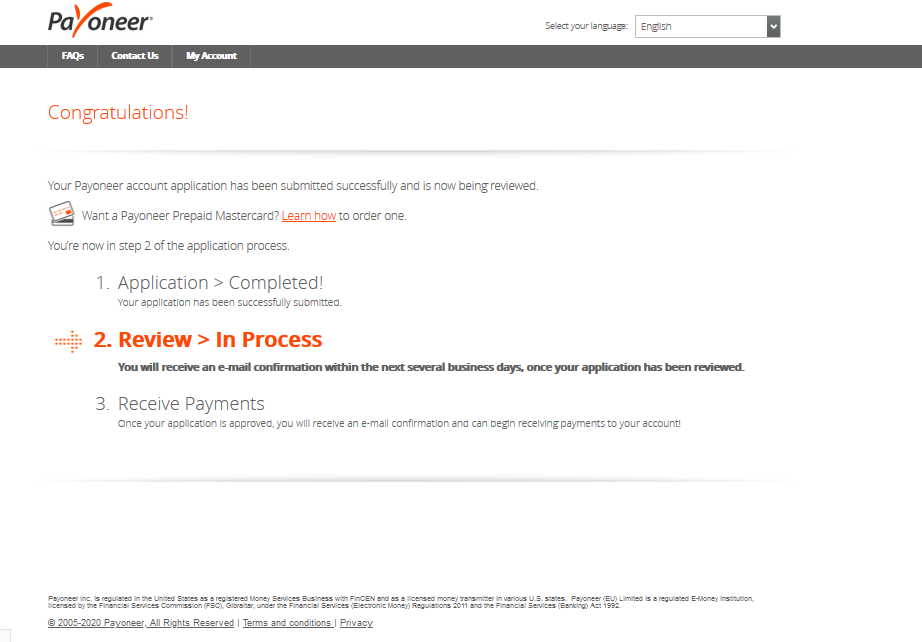

The review process can take a few days. You’ll receive an email confirmation once you are approved. Then you can apply for a prepaid MasterCard so that you can withdraw your money.

Compare the features of PayPal and Payoneer.

PayPal vs. Payoneer – An In-depth Comparison

Although both services are excellent in some scenarios, they have also their own pitfalls. If you’re going to pick one service over another, you must evaluate each case individually. Let’s take a look at some different scenarios.

Taxes and exchange rates

Both services have a wide range of differences when it comes to exchange rates or fees. You will make your choice based on the type of transactions you wish to conduct and how they affect you.

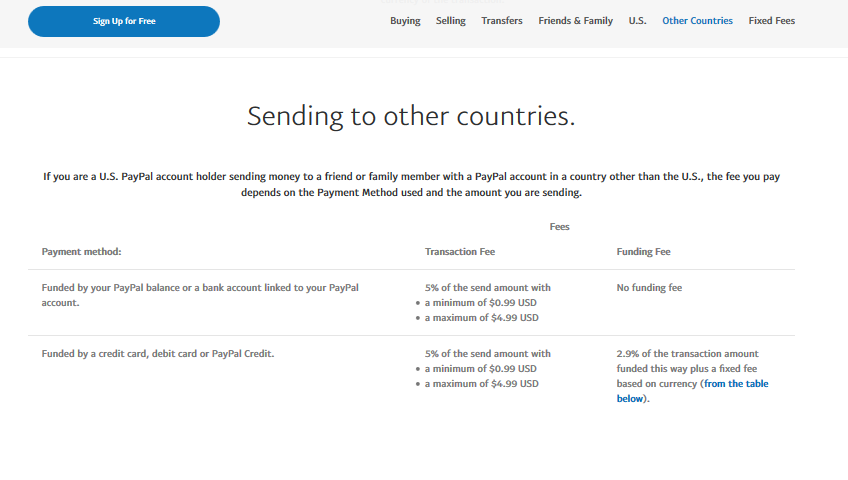

PayPal’s transaction fees depend on where you have your account registered. PayPal does not charge any fees in the United States to transfer money from your PayPal account. You will have to pay a fee if you want to use your PayPal credit, PayPal debit, or credit card. The fee is 2.9% + $0.30 per transaction.

Fees for international transactions (transactions made from the US into another country) may vary depending upon the destination, the payment method, and the amount that you are sending.

A transaction fee of 5% is charged per transaction if the money sent comes from your PayPal balance or the linked bank account. This means that you will pay between $0.99 and $4.99.

If you use your PayPal Credit or debit card to make a purchase, an additional 2.9% will be added on top of any transaction fees. There is also a fixed currency fee. Don’t forget to factor in a 2.5% conversion fee.

Payoneer charges no fees when sending or receiving funds from other Payoneer users. If you receive USD, AUD or CAD funds in your local account, the fee will be between 0-1%. However, it depends on which country sent them.

You will be charged a fee of 3% if you decide to accept funds directly from customers using a debit or credit card.

You’ll be charged a 1% charge if you choose to use an eCheck. The fees for sending money via Payoneer to marketplaces, networks, and companies such as Upwork and Airbnb or Fiverr may vary. Payoneer’s currency conversion rates are 2% higher than the mid-market rate.

The Security of Your Own Home

The security of your money is your primary concern when you transact online. Your personal information as well as your funds should always be kept safe.

PayPal and Payoneer, fortunately, rely upon high levels of encryption to safeguard their client’s funds and personal data. This ensures that third parties cannot access or manipulate any information in your account.

Payoneer for example ensures that every transaction is protected by strong encryption To ensure that all data is encrypted and protected by firewalls.

The company also monitors each transaction for fraud, identity theft and phishing. You will also receive an email if there is any activity that appears to be unusual in your account.

PayPal uses advanced encryption technology to protect your transactions. Every transaction is monitored to prevent identity theft and fraud. They have both a buyer’s and seller’s protection center for claims and chargebacks.

Speed up

Payoneer is faster than PayPal when it comes to processing global payouts and withdrawals.

PayPal is one example where you must initiate each withdrawal manually to receive cash into your bank account. The process is cumbersome, and it takes a long time. It can take up to five days for the money to appear on your account.

Payoneer on the other side, removes all of these hassles. You won’t have to wait as long to get your funds. You can receive local currency in your bank account via their Global Bank Transfer Service within 24 hours of receiving your payment. The entire process is automated.

Payoneer also has higher daily withdrawal limits. They total $5000, compared to PayPal’s $500 monthly limit for unverified accounts. PayPal withdrawal limits can however be raised by linking your PayPal account to your bank, confirming your debit or card and providing your social security.

Travel Cards/Debit Cards

Both companies offer cards that allow their customers to have access to their funds more quickly and conveniently. The availability of these cards and PayPal’s Cash Mastercard is dependent on where you live.

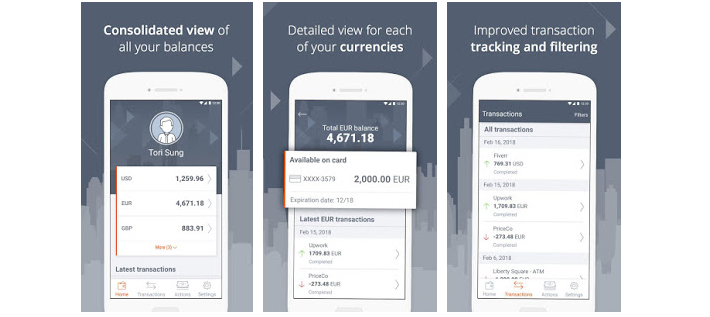

Mobile Applications

The growth of mobile technology has made it difficult to find financial services companies that do not have mobile apps. PayPal and Payoneer have not been left out of this trend. Both PayPal and Payoneer offer mobile apps on both iOS and Android so that users can send and receive funds safely and securely even when they are not at home.

It is possible to login using your fingerprint. The security of the mobile app is so advanced that it allows you to use this feature. If your account is accessed by an authorized device, then you will receive an alert.

Both mobile apps are limited to basic tasks such as viewing balances, transaction details, sending and accepting payments.

PayPal vs. Payoneer – Key Takeaways

- Both platforms provide a simple and secure online payment option for businesses and individuals. You don’t need to worry about sharing your personal data or losing your money.

- PayPal’s fees are higher than Payoneer’s, meaning that you will save money if you deal with large sums of money.

- Both platforms let you send invoices professionally.

- Both services can be easily integrated into e-commerce websites.

- Payoneer’s automated system makes it easy to automate B2B and mass payouts.

- Payoneer allows you to create a virtual US/UK account for receiving funds.

Wrapping up

It is up to you and your circumstances which payment method is best for you. If you live in an area where there are only a handful of banks that offer PayPal withdrawals, you may choose Payoneer.

PayPal is the best option if your website’s customers prefer to use PayPal instead of Payoneer.

Payoneer is the best option if you want to save money over time. Their low transaction fees, and exchange rates are a great combination.

You will have to decide which service is best for you. You should do more research before choosing one of the two services.